Investment Management software

Data forms the basis for investment management. The quality of the data ultimately determines whether investment management is successful or not.

With our software PASS Investment Management, we have developed an attractive, web-based solution based on Java that bridges the flexibility and availability gap between standardized enterprise IT (Excel in particular) and the uncontrolled growth of data islands.

Our investement management software enables you to cover the demand for highly flexible (spontaneous) data storage, processing and analysis, which enhances the quality of your data and enables you to make smart decisions. Our software is therefore the key building block for successful investment management.

Whatever sector you work in: our investment management can meet your specific requirements. The basis for this is the PASS Investment Management toolkit. This toolkit contains tools for customizing the preparation of data according to your demands in such a way that it supports the relevant business purpose. Thanks to this freedom of design, you can completely change and expand the application data model – even during production operation.

You will receive a sophisticated software solution that also guarantees maximum expandability and adaptability. The solution has been designed to be technologically “sustainable,” and can therefore be very easily adapted to future needs: PASS Investment Management is a purely HTML interface that requires no browser plugins (Flash, ActiveX, or Applets). In terms of its architecture, only a Tomcat or other JEE Web Container that meets Servlet specification 2.4 or higher is required.

Business packages for your sector

The adaptations you make in the investment management software are mapped in “business packages.” As the admin user, you are the application designer, in that you can customize the software solution to meet your specific needs in the configuration area. With full release capability, you can add fields, define tables, and fill in selection elements.

In addition, we have developed special business packages for corporate and banking sector and venture capital/private equity, which has been derived from numerous customer projects.

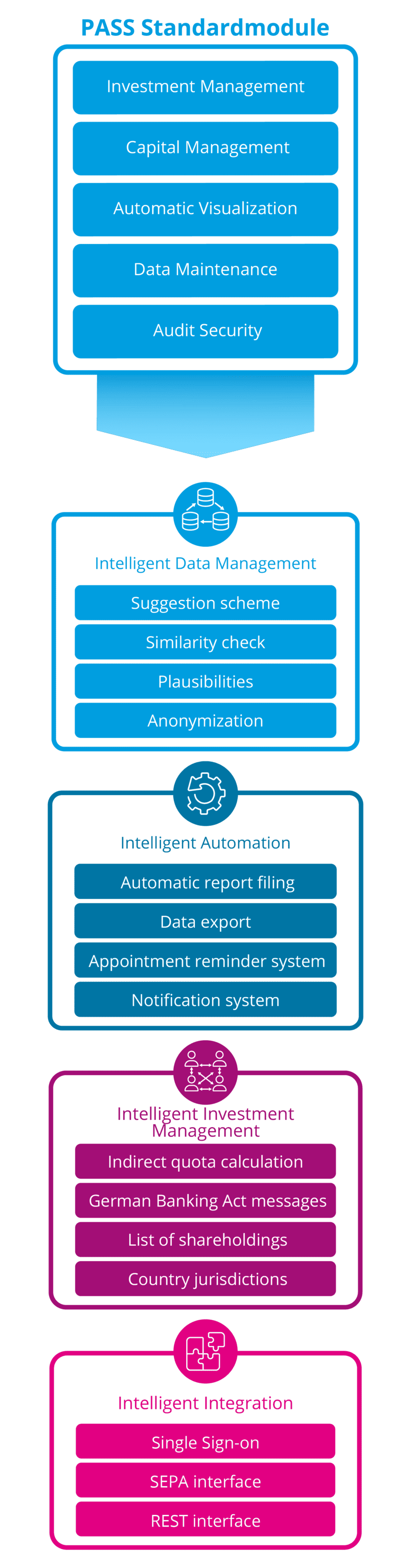

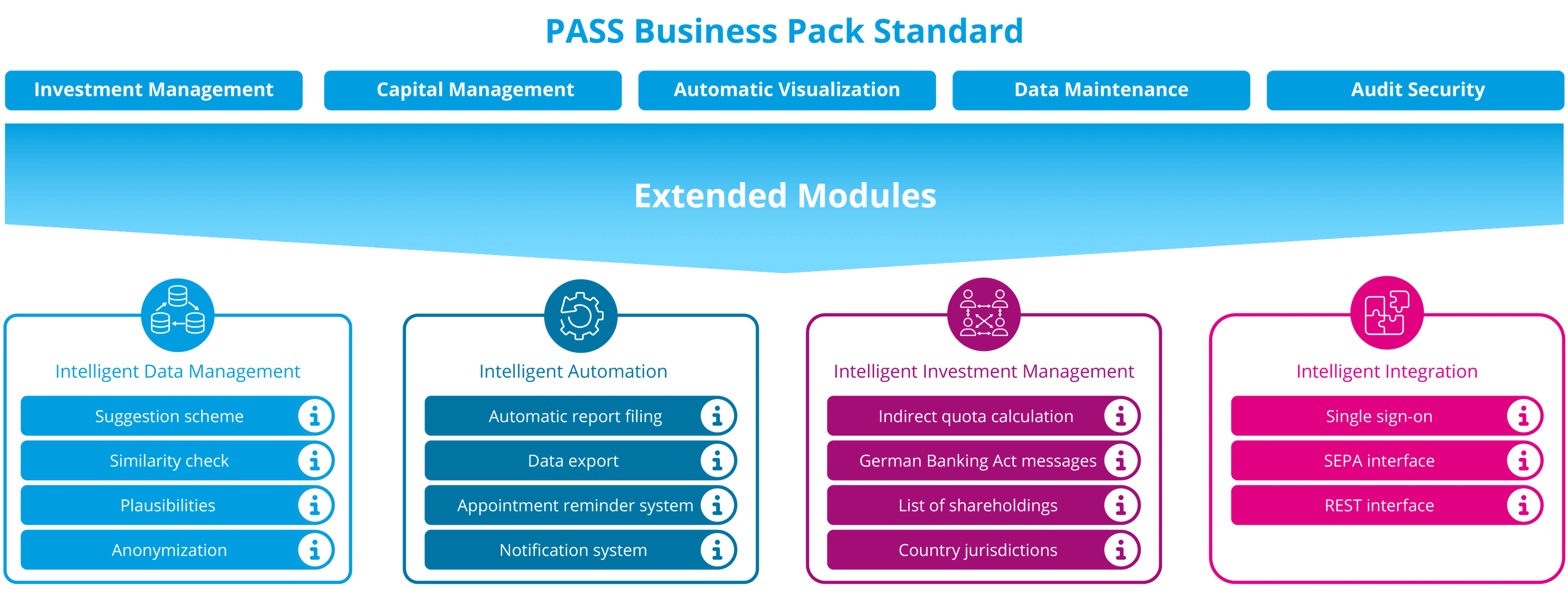

The flexibility of the PASS investment management software is also reflected in the free choice of modules. Based on the standard modules, each customer is free to decide which additional modules they would like to use. The standard version already covers a wide range of specialist requirements in investment management.

Suggestion scheme

Data maintenance via the release levels "Proposal" and "Acceptance". Historically correct data storage for "Acceptance".

Similarity check

Automatic search before saving to avoid duplicates. Sensitivity of the check is configurable.

Plausibilität

Regular, input-independent check for data consistency. Definition of any number of rules. In addition: Note in case of rule violation (e.g. share > 100%).

Anonymization

Support in handling personal data. Preventing the deletion of non-erasable information by overwriting data.

Automatic report filing

Automatic generation of PDF reports and direct storage in a data field. With the "Notification System" module: scheduled generation of a report and sending to selected recipients.

Data export

Automated, time-controlled or event-based generation of individually definable export files. Files are stored in a freely selectable directory on the server or in a SharePoint area.

Appointment reminder system

Automatic sending of an appointment reminder by message (also by e-mail incl. attachment) with freely definable lead time when an appointment or a resubmission is reached. Addressee group is freely selectable.

Notification system

Creation of any number of notification rules that alert users to data changes via message or email.

Indirect quota calculation

Extension of the standard functionality "Quota calculation" by the automatic calculation of all indirect quotas. Calculation of quotas according to various schemes (Direct (n)', Direct (s)', Accounted (n)', Accounted (s)' etc.) taking into account shares and contracts.

German Banking Act messages

Generation of the asset-side and liability-side notification of shareholdings and the notification of secondary activities. Mapping of the requirements arising from the German Banking Act, the Notification Ordinance, the Ownership Control Ordinance and the Federal Financial Supervisory Authority (BaFin) circulars and bulletins.

List of shareholdings

The customer receives a list of shareholdings individually adapted to the business pack used by him and created on the basis of the data maintained by him.

Country jurisdictions

The use of the PASS Investment Management in an international group environment is possible. The user is offered exactly those choices that make legal sense in the respective country (e.g. the legal form of a company). By default, the jurisdictions for Germany as well as Great Britain are available and can be extended for up to 70 additional countries.

Single sign-on

Automatic registration of users based on the Kerberos standard (in Windows with Active Directory or LDAP server). Unknown users receive a self-registration dialog and are automatically created with the (freely definable) default authorization.

SEPA interface

Generation of direct debits and transfers in the standardized SEPA XML format for use in the payment transaction system (e.g. S-Firm). Use cases are e.g. the regular collection of fees, redemption installments and transfer of value dates.

REST interface

Read and write access to the PASS Investment Management objects via the JSON 2 data format and thus a guaranteed, optimal integration into the IT landscape. The REST interface provides an automatically generated API documentation.

Requirements to be met by a software for investment management

The sometimes very complex requirements to the investment management were the starting point and motivation for the development of our investment management software:

- The software must automatically create a change history for each data entry. Old data should not be discarded, but preserved in the history.

- By entering a central key date, the system must travel to the specified time and then display all content with the corresponding validity. This must apply to all content, data, and documents, and must also be available for reporting.

- In investment management, it must be possible to create group graphics (group spider) easily and update them when changes are made to the investment network.

- Users must be given or denied rights to view, create, modify and delete data by means of a role concept.

- The system must generate the investment report in its entirety, incl. all chapters and graphical elements, as a PDF at the push of a button. It should not be necessary to do any subsequent work on the report.

- The investment management solution should provide convenient functions for compiling data lists and for exporting these for use in a spreadsheet program.

- In addition to the export function, the investment management software must also support standard investment reporting. It must be possible to generate default reports at the push of a button and to store these as PDFs.

- The investment management solution must offer an integrated option for managing all the legally relevant documents, in addition to data.

- The management system must also allow trained users to add new fields at any time. It must be possible to change and delete existing fields.

Features of the investment management software

Investment management is a highly complex task that calls for specific demands when it comes to an appropriate IT system. The key features of our software for investment management are historization, flexibility, and controlling.

Historization

In practice, data does not accumulate continuously, but rather historically and unsystematically. You are therefore forced to update your stocks whenever historical data is transferred. As a result, several old datasets are subsequently updated. Due to compliance requirements, the data on investments must be updated on a daily basis, and can also be corrected retroactively.

The investment management software therefore maps all data in a consistent, historical database which provides a consistent picture at all times. When a central key date is entered, the system can display all content for the relevant period and provide this content for reporting purposes.

The timeline function is available here.

Flexibility

For us, flexibility is not just a buzzword, but the core of the software solution: we want you not to have to adapt to the investment management software, but to be able to adapt it freely to your needs (while maintaining full release capability).

That’s why the our software for investment management uses a virtual data model. This means that fields and templates for the business application can be changed at any time, without the need to adapt the physical structure in the basic database. The further development of the actual business application can therefore take place completely within the PASS user interface. The tools we provide for this are so easy to use that they can also be used by pure business users.

In concrete terms, this means that you can

- add

- customize

- connect

data fields in all conceivable configurations and specify formulas for these. You can manage the data that is displayed in line with the relevant situation, change thedisplay (e.g. colors, shapes, decimal places), check plausibility, etc.

A powerful tool for this is the PASS Mathematics Engine, which you can use to calculate field content within the software interface online. Here, you have access to a kit comprising a variety of tools, which can be freely combined mathematically and logically, with a virtually unlimited scope of options. Each of these building blocks delivers a value that corresponds to a specific type:

Investment controlling

Since all key figures can also be displayed in historical form, the subsidiaries can carry out investment controlling quickly and easily based on the data provided.

The financial statement data for the companies managed can be used for this purpose and – based on our investment management system’s selection and mathematics capabilities – all conceivable KPIs (e.g. equity ratio, return on sales, return on assets) can be prepared and regularly reported on.

In addition, so-called Controlling Packages can be used: These compilations of key performance indicators are created in various categories (planned, target, actual, mid-term, projections, etc.) and for respective reference times and creation times. This enables rolling reporting on the data, as well as a comparison of planned and actual data.

This is complemented by workflow functions, an appointment reminder, a calendar feature, and an e-mail notification in the event of data changes. Our investment controlling software therefore offers all the functions you need to ensure effective controlling for your investments.

Work Simplification

Single point of information with all investment-related details and work transactions including automatic and intelligent sorting of data; ensures a coherent and consistent perspective on investments

Automation

Fully automated quota calculation to meet reporting requirements for companies, plus automated generation of investment reports for public sector customers

Legal Certainty

Fulfillment of all compliance requirements, such as the secure traceability of all data management operations and the mapping of ownership structure as required under company law

Flexibility

Optimum fulfilment of the customer-specific business purpose through use of the PASS Investment Management toolkit or predefined (but customizable) business packages

Yes. As a first step towards implementation of the investment management software, the customer puts together an individual list of functions, which we then use to give us direction. It would also be possible for the customer to implement his individual change requests (partly or fully) in admin mode himself. For this we would train the intended employees accordingly.

After the order has been placed by the customer, an integration team gradually transfers the individual functional requirements into the system. Usage and authorization concepts are documented and prepared for productive implementation. Alternatively, we can train you so that you are able to make the functional adjustments yourself.

License purchase

Software leasing

Software as a Service

What are the main features of the model? What does PASS do?

License purchase

License including extensive maintenance and services, including subscription to new versions and ticket processing

Software leasing

Same as license purchase

Software as a Service

Product license including hosting of the software in our data centers in Germany

Billing

License purchase

One-off license fee and annual maintenance fees

Software leasing

Monthly license fee (incl. maintenance fees)

Software as a Service

Monthly user fee